boulder co sales tax rate 2020

The Boulder County Sales Tax is 0985. If your business is located in a self-collected jurisdiction you must apply for a sales tax account with that city.

File Sales Tax Online Department Of Revenue Taxation

The minimum combined 2022 sales tax rate for Boulder Colorado is.

. The Boulder County sales tax rate is 099. 2020 BOULDER COUNTY SALES USE TAX The 2020 Boulder County sales and use tax rate is 0985. You can print a 8845 sales tax table here.

This is the total of state county and city sales tax rates. Determining the increase in base revenue can be. Sales and Use Tax Year to date YTD sales and use tax based upon current economic activity.

Ad Find Out Sales Tax Rates For Free. Boulder co sales tax rate. As permitted under CRS 39-10-1115 delinquent mobile home taxes may be struck off to the county rather than being offered for sale at auction.

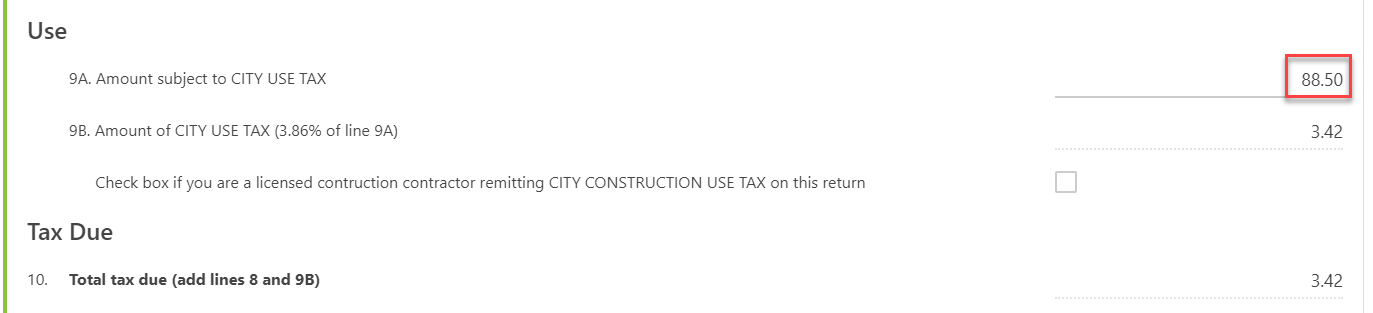

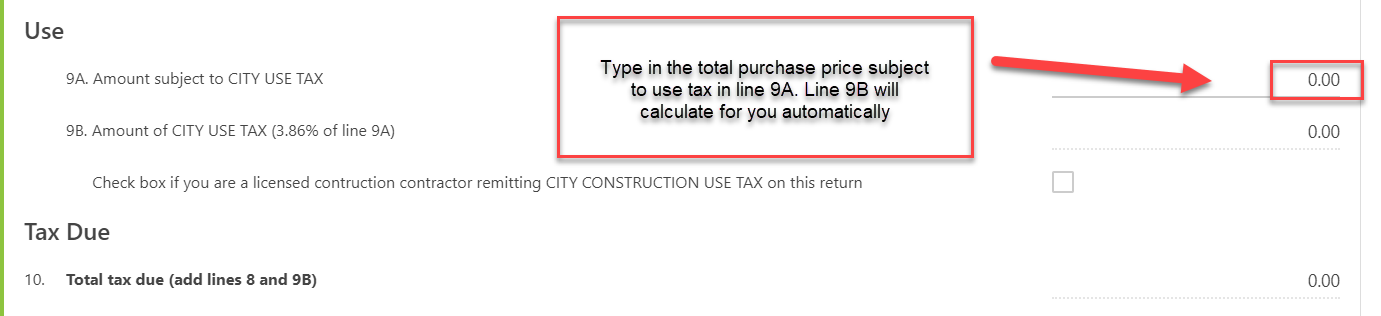

The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. The December 2020 total local sales tax rate was 8845.

Our tax lien sale will be held December 2 2022. Para asistencia en español favor de mandarnos un email a. The Boulder County Sales Tax is 0985.

For tax rates in other cities see Colorado sales taxes by city and county. The December 2020 total local sales tax rate was 8845. County of Boulder 0985 Sales Tax Use tax on Building Materials and Motor Vehicles Open Space 0475 0125 ending 123134 010 ending.

The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. 265 Bellevue Dr Boulder CO 80302-7817 is currently not for sale. The December 2020 total local sales tax rate was 8845.

6232020 10321 PM. Did South Dakota v. Boulder County does not issue licenses for sales tax as the county sales tax is collected by the Colorado Department of Revenue CDOR.

Tax Lien Interest Rate. Mobile Home Tax Lien Sale. Boulder CO Sales Tax Rate.

What is the sales tax rate in Boulder Colorado. The County sales tax rate is. The City of Lovelands sales tax rate is 30 combined with Larimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670.

The 2020 Boulder County sales and use tax rate is 0985. 2055 lower than the maximum sales tax in CO. The minimum combined 2022 sales tax rate for Boulder County Colorado is 499.

The Colorado state sales tax rate is currently 29. Boulder Countys Sales Tax Rate is 0985 for 2020 Sales tax is due on all retail transactions in addition to any applicable city and state taxes. Boulder County CO Sales Tax Rate.

Notice that we use 2020 millage rates since 2021 rates are not available yet. Colorado assesses a flat tax of 463 percent of an individuals taxable federal income. ICalculator US Excellent Free Online Calculators for Personal and Business use.

The current total local sales tax rate in Boulder County CO is 4985. This is the total of state and county sales tax rates. Our tax lien sale will be held November 18 2022.

As of July 1 2020 tobacco retailers must collect and remit the 40 sales tax on Electronic Smoking Devices including any refill cartridge or any other ESD components. The 2020 Boulder County sales and use tax rate is 0985. Fast Easy Tax Solutions.

Some cities and local governments in Boulder County collect additional local sales taxes which can be as high as 51. Salestaxbouldercoloradogov o llamarnos a 303-441-4425. Visit Where can I get vaccinated or call 1-877.

This document lists the sales and use tax rates for all Colorado cities counties and special districts. About City of Boulders Sales and Use Tax. The current total local sales tax rate in Boulder CO is 4985.

The December 2020 total local. This home was built in 1979 and last sold on for. The Boulder Sales Tax is collected by the merchant on all qualifying sales.

Tax description Assessed value Millage rate Tax amount. Crowley Exemption Added 2. Boulder co sales tax rate 2020 Sunday March 20 2022 Edit.

CO Sales Tax Rate. For tax rates in other cities see. Some cities and local.

Wayfair Inc affect Colorado. To find all applicable sales or use tax rates for a specific business location or local government visit the How to Look Up Sales Use Tax Rates web page. The Colorado sales tax rate is currently.

A county-wide sales tax rate of 0985 is applicable to localities in Boulder County in addition to the 29 Colorado sales tax. It also contains contact information for all self-collected jurisdictions. The Boulder sales tax rate is.

Boulder in Colorado has a tax rate of 885 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Boulder totaling 595. The rate for certificates sold in 2022 will be set. 2055 lower than the maximum sales tax in CO.

The ESD tax is on top of the City of Boulder sales tax rate of 386. The Boulder County Remainder Colorado sales tax is 499 consisting of 290 Colorado state sales tax and 209 Boulder County Remainder local sales taxesThe local sales tax consists of a 099 county sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Colorados corporate income tax rate is a flat 463 percent assessed on Colorado net income defined as the corporations federal taxable income with some modifications.

Jurisdiction Tax Rate Exempt Use Tax Service Fee. Microsoft Word - 2020 Sales Tax Rates 2nd Half Author. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs in conservaon transportaon offe nder management nonprofit capital.

July to December 2020. The 2018 United States Supreme Court decision in.

Sales And Use Tax City Of Boulder

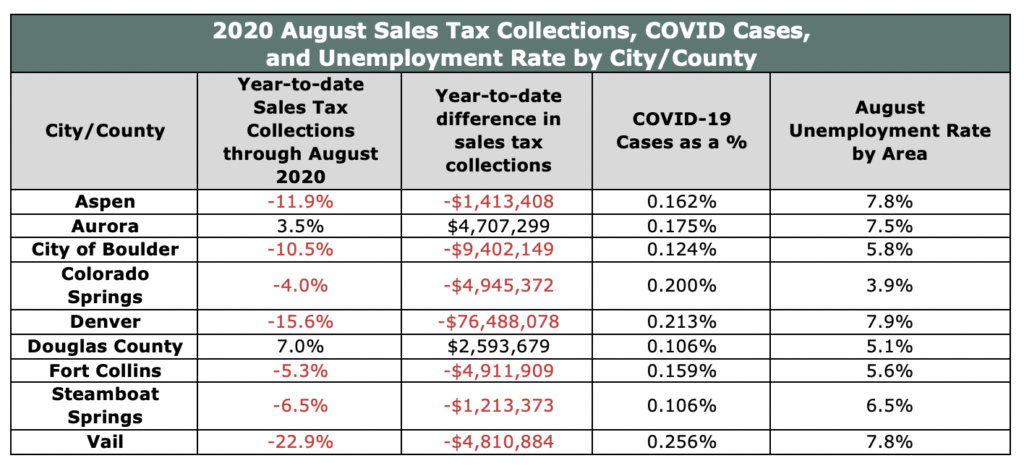

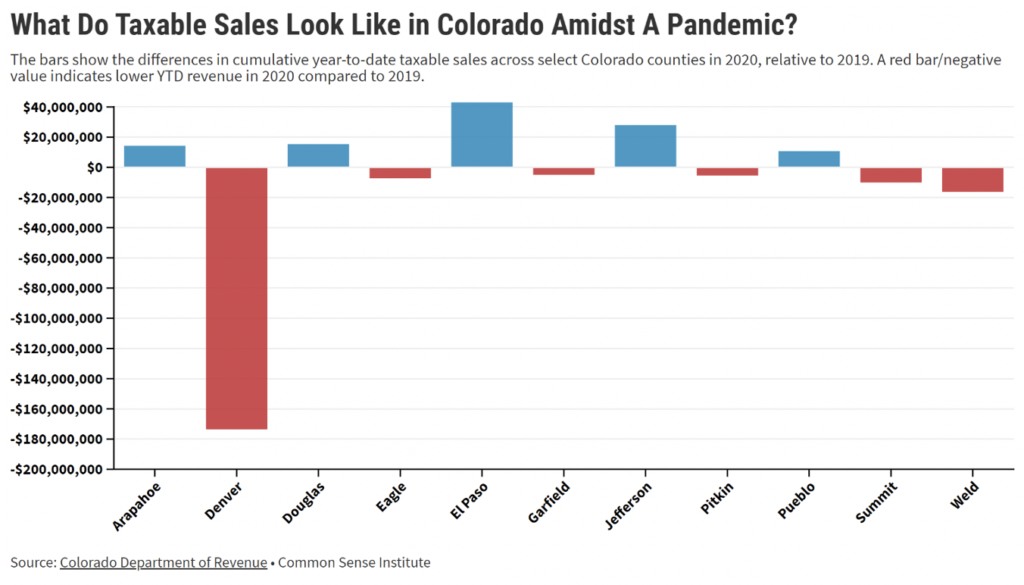

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

The Economic Effects Of The Marijuana Industry In Colorado Federal Reserve Bank Of Kansas City

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Nevada Sales Tax Guide For Businesses

Colorado Sales Tax Rates By City County 2022

2021 Property Appraisals And Tax Rates For Resorts At Walt Disney World

Taxes In Boulder The State Of Colorado

2021 Property Appraisals And Tax Rates For Resorts At Walt Disney World